Seamless spend and expense management with BILL

CPA.com and BILL

BILL Spend & Expense

Video

What is spend management?

BLOG

Expense reports are no longer a requirement with a spend management solution

WATCH A DEMO

Discover seamless spend and expense management with BILL

Optimize your advisory services with BILL Spend & Expense

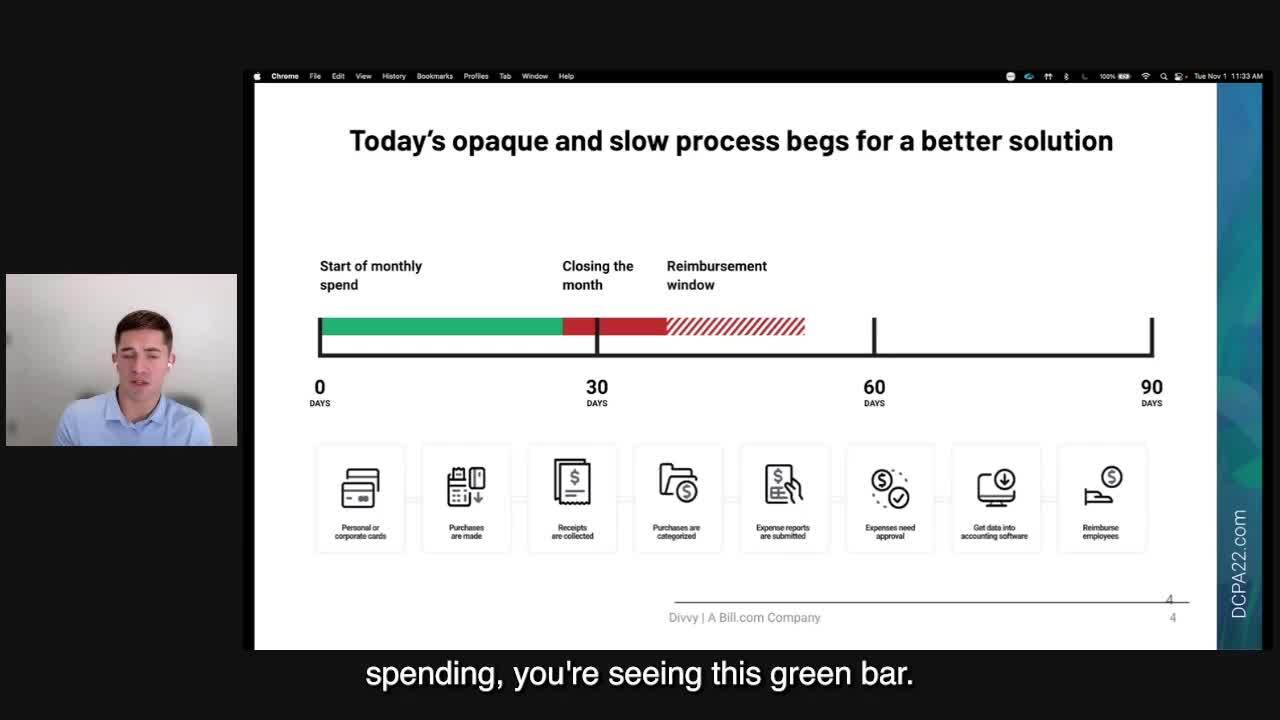

Spend and expense management is a low-lift and approachable client advisory service (CAS) area that offers immediate benefits for both your clients and your firm. With BILL Spend & Expense’s (formerly Divvy) integrated financial platform and client-issued corporate cards, you’ll be well positioned to offer higher-level advisory services including enhanced forecasting, budgeting and business planning.

How does it work? Corporate cards are issued to your client and connected to the BILL Spend & Expense platform, so all company spend is not only pre-approved, but also tracked in real-time. Instead of chasing down receipts at month-end, your staff has more time to focus on delivering the strategic insights your clients want and need.

What is spend management?

Watch this short video to learn more about this approachable advisory opportunity, and how spend management technology works for you and your clients.

Empower your firm and clients with BILL Spend & Expense

With BILL Spend & Expense, firms help clients streamline expense management, simplify financial operations, and make quick reimbursements effortless, all while increasing firm efficiency.

Benefits for clients

Corporate Cards For All:

Assign physical or virtual cards to all staff, or for specific budget lines.

Empowered Budgeting:

Set and implement enforceable budgets for enhanced financial control and discipline.

Real-Time Financial Tracking:

Instant expense categorization and timely spend notifications.

Optimized Financial Management:

Get access to business credit complemented by easy card management.

Smooth Operational Workflows:

Seamless accounting software integrations and a real-time dashboard for transaction insights.

Hassle-Free Reimbursements:

Ensure quick, accurate, and transparent transaction reviews for effortless reimbursements.

Benefits for firms

Automate Manual Accounting Tasks:

Eliminate operational hurdles in expense management and closing the books, freeing up more time for client focus.

Technology That Works For Your Clients:

User-friendly apps allow convenient access and simplified spend management with real-time categorization and budget controls.

Seamless Software Integration:

Effortlessly sync transactions between BILL Spend & Expense and your accounting system, eliminating the need for manual toggling.

Real-Time Visibility:

Track client spending by function or budget - instantly from one dashboard.

Partner with BILL and CPA.com

Join the BILL Accountant Partner Program to access dedicated support, exclusive training, and user-friendly tech. Enhance client experiences with robust features and rewards, seamless software integrations, and elevate your firm through co-marketing opportunities and efficient operations.

Automate client AP, AR, spend, and expense with BILL’s new financial operations platform

Save time and gain full control over your clients' financial operations with BILL’s new integrated platform, featuring BILL Accounts Payable, BILL Accounts Receivable, and BILL Spend & Expense, to help you seamlessly automate your clients’ business finances across all three products and elevate your accounting practice.

- Access AP, AR, and spend and expense with one login and easily move across products

- Get one centralized view of AP, AR, and spend and expense in a single dashboard

- Automatically sync AP, AR, and spend and expense together with your accounting software for faster month-end close

- Stay organized with a streamlined cash flow task list

Testimonials

What BILL Spend & Expense has done for us and with our clients is that we are having faster, more proactive conversations at the end of the month instead of always being reactive. And I love that.

Dan Luthi, Partner

Ignite Spot Accounting Services

Clients are coming to our firm because they know we offer cash flow management, forecasting, spend management with BILL Spend & Expense, and all the things they need to have a good grasp on accounting. We can provide them with solutions that are going to help and improve their business while allowing them to operate their business in a much better position than before.

Jody Grunden, CEO & Co-founder, Summit Virtual CFO

by Anders CPAs

We are finding that our average growth is at least double, if not triple, the median on our client advisory services. Spend management is just the thing that our clients need the most.

Megan Bronson, Advisory Partner

Squire & Company

Additional CPA.com resources to keep you more informed:

WATCH

READ

The power of smart business

The advisory landscape is changing rapidly and one word — complexity — defines both the greatest challenge and opportunity for CPAs. To keep pace with client expectations, firms are rethinking their strategies for practice management, client services and talent development.

CPA.com is your primary source for taking the complexity out of moving your firm into the digital arena — enabling you to focus on growing your business with the smartest solutions in our profession.

To learn more about CPA.com, please contact our team at inquire@hq.cpa.com or by calling 1.855.855.5CPA.

Card issued by Cross River Bank, Member FDIC.