A guided approach to reaching Business Insights CAS

The right coach and tools to build your practice

CPA.com

CAS 2.0® Practice Transformation Coaching

If you're grappling with how to scale and expand your client advisory services (CAS) practice, you're not alone. In fact, most CAS leaders struggle with roadblocks at some point along the journey whether it be with leadership alignment, staffing and upskilling, or technological implementations - just to name a few.

CPA.com's team of CAS Professional Services experts is here to help. We have a proven track record of helping firms of all sizes progress in their CAS journey in a scalable and profitable way.

The CAS 2.0® Practice Transformation Coaching Program

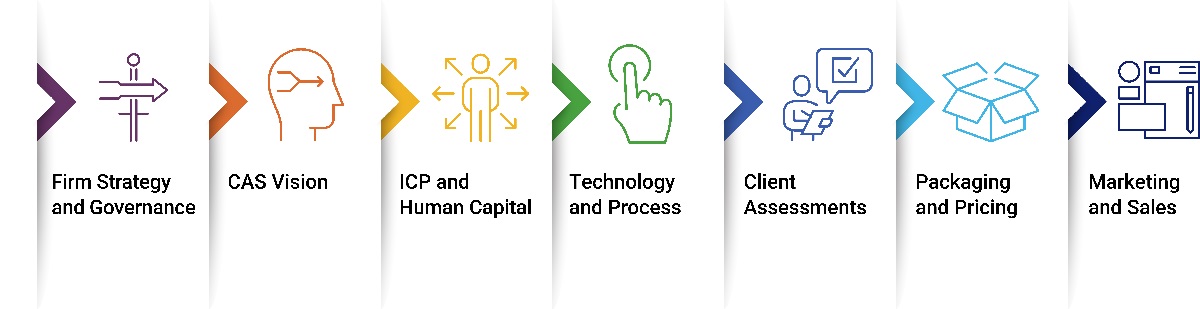

An award-winning, progressive, guided approach to driving transformation across 7 key strategic themes:

Accelerate your firm's CAS practice with our holistic, multi-step coaching program

- Pre-coaching alignment: Kickstart your journey with a leadership survey to evaluate your firm's current strategy and governance. This crucial step pinpoints strengths and underlying obstacles to growth, setting the stage for accelerated practice transformation.

- Interactive group sessions: Dive into virtual sessions covering essential CAS practice development topics. Learn and grow with other CAS leaders in a structured, educational environment.

- Roundtable discussions: Collaborate and share insights in roundtable discussions with fellow CAS practitioners, focused on topics that bolster your coaching goals and overall success.

- Personalized 1:1 coaching: Benefit from individualized sessions with our team of CAS experts. We'll help you set clear goals and identify success factors unique to your firm's needs.

- Action-oriented strategic business plans: Develop a focused, actionable execution plan. This guide provides clear direction and accountability, helping you track and achieve progress.

- Workshop access for your team: This pathway includes 2 seats in CPA.com's Introduction to CAS Workshop, 2 seats to the CAS 2.0® Practice Essentials Workshop, 6 seats to the Introduction to CAS for Staff workshop, as well as access to a suite of introductory self-study courses.

- Access to the CAS 2.0® Coaching Toolkit: A collection of high-value tools and resources offered to firms to create the practice strategy and save time executing on that practice strategy.

The coaching that even the most trusted advisors need

CPA.com’s CAS 2.0 Practice Transformation Coaching Program delivers all of the expertise and resources needed to accelerate your CAS practice transformation. You'll benefit from a step-by-step, proven approach to change management and practice development that will allow you and your team to plan, build, and grow your CAS practice faster.

The Coaching Program will help you:

- Reach your goals faster: The program is tailored to align your firm's objectives with a comprehensive CAS practice development plan, ensuring accelerated progress.

- Learn from experts: Gain invaluable insights from professionals with extensive real-life experience in CAS practice transformation.

- Focus on improvement: Pinpoint key areas needing enhancement, offering strategies to tackle challenges, address issues and spark innovation swiftly.

- Enhance team resilience: Equip your team to adapt to overcome obstacles and manage changes more effectively, fostering a resilient and responsive workforce.

- Make smarter decisions: Benefit from frameworks and techniques designed to enhance your decision-making process.

- Gain fresh perspectives: An authoritative and unbiased approach provides new insights and alternative strategies to rejuvenate your practice.

- Cultivate a growth mindset: Foster a positive, future-focused culture within your CAS practice.

Additional CAS 2.0® Professional Services offerings

CAS 2.0® Practice Introduction

A structured learning experience introducing you to the foundational aspects of CAS.

CAS 2.0® Practice Development Essentials

A comprehensive solution designed to build or enhance your CAS practice.

Building a future ready firm

The accounting landscape is changing rapidly and one word—complexity—defines both the greatest challenge and opportunity for CPAs. To keep pace with client expectations, firms are rethinking their strategies for practice management, client services and talent development.

CPA.com is your primary source for taking the complexity out of moving your firm into the digital arena – enabling you to focus on growing your business with the smartest solutions in our profession.

To learn more about CPA.com, please contact our team at inquire@hq.cpa.com.