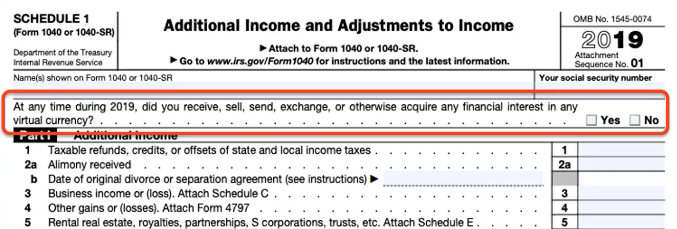

How many of your clients with crypto assets are aware the IRS requires them to include crypto transactions on their 2019 taxes? If your clients are like most, the answer is probably “not enough.” Especially at this moment, when issues such as Paycheck Protection Program (PPP) loans are dominating client conversations at firms, reporting of crypto assets may not even make the top 10 list of concerns about their taxes and finances. Yet clients with crypto assets can’t afford to let other issues push crypto reporting off the agenda.

Today’s challenges have created an unlikely opportunity to help your clients navigate this issue. With the tax season being extended this year, there is still an ample window of time in which you can help clients become aware of the need for reporting crypto assets and help them comply with the IRS. But you’ll need to move quickly before that window closes. Here are some of the most important steps you should take, starting today.

Reach out to clients now

Do you know which clients have engaged in crypto trading over the past few years? Because there hasn’t been explicit instruction from the IRS to report these transactions until now, this may never have come up in client conversations. You may be surprised to find out just how many own crypto assets. For 2019, there are an estimated 20 to 40 million crypto filers, and three-to-eight million are expected to refile for 2018 alone. Some of those are probably your clients.

It’s your responsibility to put crypto reporting issues on their radar, if you haven’t already done so. Clients often provide the same tax data year over year, given no major changes. If they didn’t provide crypto reporting information last year, why would they think to do it this year? To help you get the word out, we’ve highlighted some practical ways to get your clients up to speed:

- Update Organizers: Don’t just ask if the client has traded crypto – explain the importance of properly reporting these transactions and why there is a change in reporting requirements for 2019 compared to previous years. You should also explain the implications for clients if they don’t report properly.

- E-mail blast to your client list: This can be an educational and informational e-mail blast updating clients on the reporting requirements and the importance of properly notifying the firm if they are trading crypto currencies.

- Client Newsletter: Many firms provide their clients monthly or quarterly newsletters that not only provide firm updates but also update clients on new tax requirements. These crypto requirements should be considered front-page news.

- Virtual Client Conversations: Due to today’s uncertainty, what used to be face-to-face meetings have now shifted to virtual meetings. In these meetings, don’t forget to add a “crypto” line item to your agenda for tax return review discussions. It’s not too late for one final mention or reminder about crypto reporting.

The tax season extension has provided firms additional time to prepare for the shift in crypto tax reporting. But the window is closing for clients to register this as an issue worthy of their attention, gather whatever information they need for filing, and coordinate with your team in order to ensure accurate reporting this season.

Evaluate crypto-focused tax technology packages

Crypto tax reporting isn’t just difficult for clients – it can be difficult for firms, too, at least those that aren’t taking advantage of technologies developed specifically for crypto reporting tasks. The IRS isn’t offering much by way of guidance on crypto, either. Plus, there are no standards in the crypto ecosystem. The reporting of crypto trading can be particularly complex due to the thousands of unique types of crypto assets, causing a range of inconsistent data formats. Unlike traditional currencies and investments, crypto assets are held and transferred between hundreds of independent exchanges that may each call the same asset by a different ticker symbol. This makes manual calculations, establishing cost basis, and assigning fair market value (FMV) far more difficult than other transactions. It is risky to assume that traditional tax preparation software is capable of correctly handling crypto transactions.

For firms looking to help crypto clients, having the right technology in place can make all the difference. Software packages can streamline the ability to track thousands of different crypto assets, automatically standardize transaction data from hundreds of independent exchanges, and properly assign FMV to transactions that do not have U.S. dollar denominations – a task that is virtually impossible for any single firm. Crypto-focused software can also automate key processes, such as properly calculating the cost basis of digital assets when commission and fees are paid in crypto assets.

Not all crypto tax packages are the same, however –most are built by pure tech companies with little input from CPAs or other tax professionals. For example, one popular crypto tax package fails completely to adjust the cost basis for fees/commission (such as those charged when purchasing a crypto asset), resulting in higher capital gains taxes for filers. Perhaps even more important, this type of oversight can trigger an audit, particularly as the IRS cracks down on the misreporting of crypto assets and transactions.

The tools you use are a measure of your ability to look after your clients’ interests on crypto issues. Make sure you select tools that ensure you are accurately calculating crypto gains and losses. Equally important, look for a tool that is built on a tested, secure SOC 1 Type 2/SOC 2 Type 2 infrastructure.

Shift your mindset

Crypto reporting is here to stay. If anything, it’s only going to grow in importance as cryptocurrency use becomes more widespread. So don’t allow your own team or your clients to fall into the trap of treating this as a one-off issue – even in the midst of this unprecedented environment, which has introduced new challenges and issues to clients and firms alike. Clients still need to embrace the idea that accurate crypto reporting is important now – and for many, that requires a shift in mindset. Enabling that shift will require constant, clear communication on your part, in client conversations, in document reviews, and (of course) in tax preparation itself. The time for that shift is not sometime in the near future. It’s right now.

Does this feel overwhelming? It shouldn’t – especially since the tax season extension has given firms and clients precious time to get on top of crypto issues. Just as important, there are plenty of tools and technologies that can help. For starters, if you or anyone in your firm needs more education on crypto-related issues, here are some helpful resources:

- AICPA certificate program: Blockchain and Virtual Currency Implications for Tax, as well as a course, IRS Guidance on Taxation for Virtual Currency.

- AICPA Practice Aid: Accounting for and Auditing of Digital Assets

- Revenue Ruling 2019-24

- FAQ’s on IRS Website

- CPA.com Partner Resources: Access year-round content and knowledge on the cryptocurrency ecosystem covering topics such as tax reporting, forks & air drops, mining & staking, etc.

There are plenty of powerful, proven cloud technology solutions available to you as a trusted advisor that can enhance your relationships with clients, extend your capabilities, and make it easier to tackle new issues. We work with the leading providers of cloud-based crypto tax software and can help connect you with the resources you need to help clients navigate this important new dimension of tax reporting.