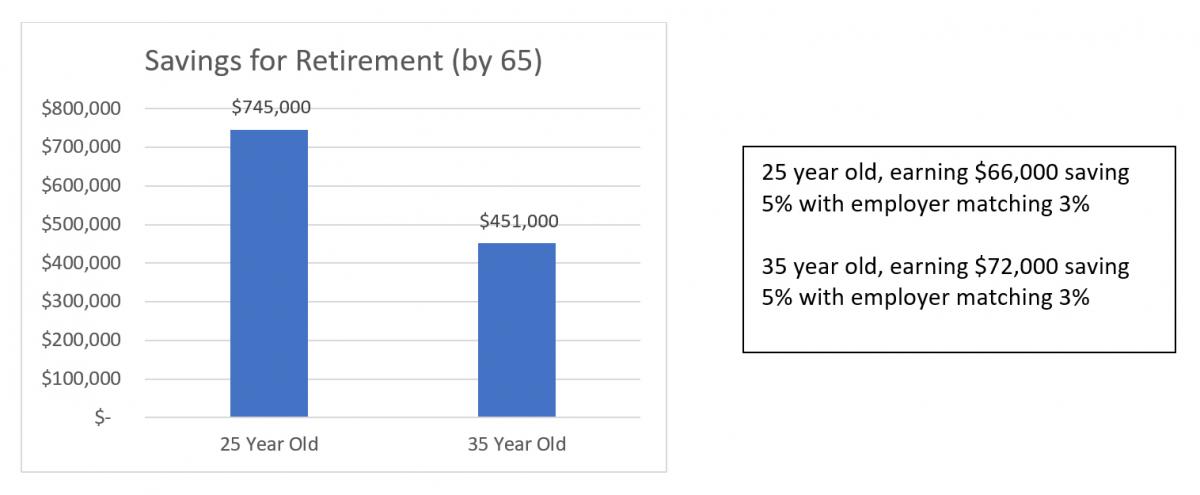

People always regret not starting to save for their retirement early enough. This new year, invest in your employees by starting a retirement plan.

The earlier you start to allocate your money for retirement, the more you will have when it comes time to reap the fruits of your labor. Don’t miss out on giving your employees this excellent head start. There are many types of retirement plans, and one of the most well-known is the Traditional 401(k) plan, which allows for a more comprehensive choice of options. Our free case study dives into what kind of differences you can expect with the 401(k) as opposed to other plans, such as the Simple IRA.

A 401(k) retirement plan doesn’t just help your employees; it helps your firm as a whole. An investment in your employees is an investment in your firm. Our case study Our case study shows how TBK recognized the importance of protecting the financial future of their employees. Not only did a retirement plan take care of those within the firm but it also was a great recruiting tool to attract new employees.

If you don’t have a retirement plan or want to benchmark your current one, take these next steps.

- Take a look at the benefits of the AICPA Plans for Firms retirement program and how it can help your firm and employees.

- Contact us to speak with a retirement specialist and complete your top new year’s resolution today.