Client expectations have changed overnight. In the wake of the Wayfair decision, accounting firms are expected to be experts on sales and use tax (SUT), and provide guidance, consulting, and compliance services.

Firms understand the apprehension and stress this ruling has created for their clients; however, in many cases, they themselves lack the internal resources available to provide or expand SUT service offerings. This has created a perfect storm and the perfect opportunity for any driven accountant looking to define their career path. Becoming knowledgeable about the Wayfair decision and how it impacts clients allows an accountant to develop expertise in specialized advisory area.

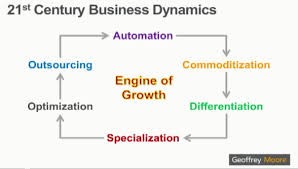

The 21st Century Business Dynamic

The 21st century business dynamic outlined by Geoffrey Moore offers a look at the progression and evolution of the business landscape today. We can gain perspective on the impacts that modern technology and automation have on the accounting profession and accountants. By applying this framework, we can understand how the role of the accountant is evolving from a compliance-driven role to a specialty role that leverages a CPA’s extensive knowledge through consultative and advisory services.

Outsourcing

As firms look to enhance client service offerings and increase bottom line revenue, many are expanding services to include SUT outsourcing. We are seeing more and more firms offering calculation, return preparation and return filing services. This expansion is not only seen within State and Local Tax (SALT) service lines but has expanded to Client Accounting Service (CAS) practices.

With the expansion of SUT outsourcing services, the firm will need to rely on accountants who are driven and willing to learn and expand their knowledge. This provides the opportunity for an accountant to become a champion, drive the service offering, and be held accountable for enhancing this service. Think of this as the foundation or the steppingstone to becoming a SUT specialist.

Automation

With the increase in SUT outsourcing services, we see a natural progression and evolution to automation. As firms grow their outsourced services, they incorporate technology and develop processes to enhance and strengthen the client experience while internally increasing productivity and profitability on SUT services.

Automation can benefit the firm and the accountant by providing the tools needed to keep up with changing sales and use tax rates and rules, streamlined reporting and the ability to organize data for an audit. Without automation, SUT compliance can be very time consuming when you add up the activities that compliance encompasses from calculation, compiling returns, filing returns, and managing reporting.

Additionally, experiences in the research and evaluation of technology can strengthen and expand the role of the accountant as they provide advice on the technology solution that aligns with the overall business plan and service offering of the firm. The accountant will become the go-to person throughout the evaluation, and the opportunity is there to be the expert on the implementation of the technology and its day-to-day use. By automating, the accountant has enhanced their knowledge base beyond SUT compliance to include SUT technology and automation. They will be involved with streamlining processes within the firm, and most importantly impacting services delivered to clients using state-of-the-art technology.

Commoditization

As we evaluate the current landscape of the accounting profession, we understand that not all firms are providing SUT compliance services. However, we see momentum building as more firms come to understand the impact SUT has on their clients, as well as the firm opportunity for expansion, growth and differentiation due to this service offering. In Accounting Today’s 2019 Top 100 Firms Report, highlighting top niche services among the top 100 firms in the United States, they ranked SALT as second, with a total of 76 percent experiencing growth.

As we continue to see growth in the profession, we must be aware that we start seeing commoditization of services when SUT service offerings are automated and focused on calculation, returns and transactional processing. To avoid this diminishing value, the accountant can transition to an advisor and strategic partner by redefining their role and helping clients navigate areas such as nexus, audit representation, and product taxability.

This is where we see the accountant role truly begin to transform from a compliance-driven role to a specialty role built on extensive knowledge and offered through consultative and advisory services.

If what you are doing as a professional can continue to be automated and you don’t change or elevate to a higher level of service, you are at risk for commoditization.

In part 2 of this series we will discuss differentiation and specialization and how to expand services from SUT compliance to consultative and advisory services and SUT specialization.

Reference: On June 21, 2018, the U.S. Supreme Court voted on a historic ruling (South Dakota v. Wayfair) favoring South Dakota, overturning Quill and determining that states can broadly require online retailers collect sales tax even if they lack physical presence.

Marianne has over 10 years of experience working with the tax and accounting profession, guiding and consulting firms as they embrace technology, evaluate internal processes and expand service lines. She consults with firms across the profession, providing guidance on the changing SUT regulatory environment, the accounting firm opportunity and SUT business development.