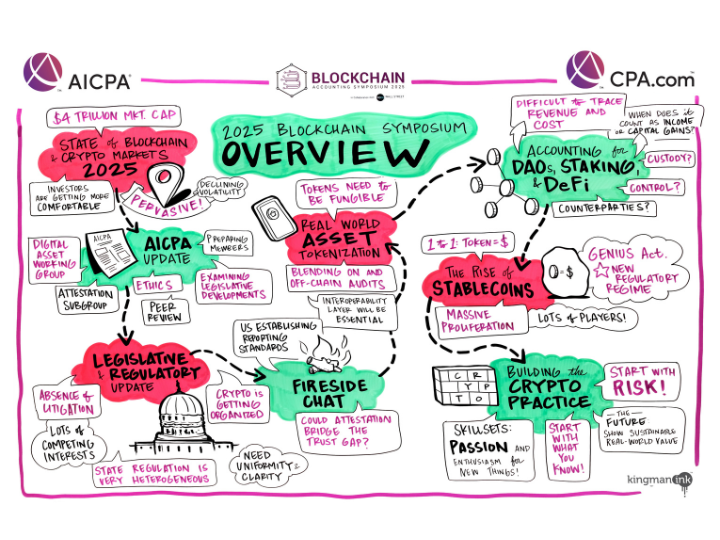

Top themes from the AICPA and CPA.com Blockchain in Accountancy Symposium

Watch a discussion on key takeaways from the Blockchain in Accountancy Symposium at a recent AICPA Town Hall.

Blockchain has entered a new phase of maturity, evolving from niche innovation to a driving force in global accounting and finance. Digital asset markets have reflected that shift, with the total crypto market cap nearly doubling from $2.28 trillion to more than $4 trillion at its peak in 2025, and 28% of American adults now owning digital assets. Bitcoin surpassed $126,000, reaching a new all-time high and driving record daily trading volumes of roughly $150 billion — up from about $100 billion the year prior.

In 2026, Bitcoin and other crypto assets have pulled back from these highs. Total crypto market cap is down to $3.2 trillion in 2026, with Bitcoin down near $91,000 amid macroeconomic pressures, interest rate concerns and the U.S. government shutdown. This market evolution reflects a broader shift in how money moves, value is recorded and trust is built across the financial system.

At the latest CPA.com and AICPA Blockchain in Accountancy Symposium, hosted in collaboration with the Wall Street Blockchain Alliance, leaders from across regulatory, legislative, finance and accounting examined how the digital asset evolution is influencing the profession. It’s reshaping payments, financial reporting, regulatory frameworks and assurance — and redefining the opportunities for firms to guide clients with clarity and confidence.

Here are a few of the top takeaways from the event.

Tokenization and the next phase of digital asset adoption

Blockchain’s evolution is moving from theory to application. Tokenization — the process of digitally representing a physical or intangible asset for use on a blockchain — is driving new efficiencies in how value is exchanged, recorded and settled across financial systems. The greatest traction so far has come in standardized markets like money market funds and bonds, where blockchain is already reducing costs and speeding settlement. More complex assets, such as real estate or mortgages, are being contemplated as the industry aligns on data and valuation, as well as legal and regulatory standards.

At the same time, tokenized fiat currency is emerging as the next major innovation. Deposit tokens — issued by regulated banks and backed by existing deposit protections — are bridging traditional finance and digital assets. Unlike stablecoins, which are often issued by private entities, deposit tokens operate within existing regulatory frameworks, providing institutions with a trusted way to transact digitally. As these models mature, CPAs will play a crucial role in validating custody and valuation, auditing the integrity of on-chain and off-chain data, and helping clients adapt to the growing integration of digital and traditional finance.

DeFi, DAOs and staking expand the boundaries of blockchain innovation

While regulated financial institutions are advancing tokenization and digital asset adoption, decentralized finance (DeFi) is also reshaping how financial systems operate. DeFi refers to a set of financial services offered on public blockchains that operate without traditional institutions, using software to support functions such as trading or lending. Through smart contracts, decentralized protocols now facilitate lending, trading and liquidity management on-chain, creating new efficiencies, but also new risks.

Staking, which underpins the security of networks like Ethereum and offers rewards to participants who support the network’s operation, is becoming a mainstream economic activity that raises questions around income recognition, valuation and reporting — areas that require professional guidance and assurance.

At the same time, decentralized autonomous organizations (DAOs) are emerging as a new form of governance and collaboration. These community-driven entities manage treasuries, approve proposals and fund innovation through transparent, blockchain-based voting. As they evolve from experimentation to structured operations, DAOs will need robust frameworks for financial oversight, control design and assurance. For CPAs, this represents a growing opportunity to extend their expertise into the decentralized ecosystem, bringing the same standards of trust and accountability that define the profession’s role in traditional finance.

Policy momentum is building toward greater clarity

The regulatory environment for digital assets is starting to take shape — more organized than before, but still far from settled. After years of “regulation by enforcement,” federal agencies have pulled back from sweeping crackdowns and are focusing more on clear cases of fraud. That’s created a rare moment of calm, but also some uncertainty. Companies can operate with more confidence, yet still lack consistent rules for token issuance, disclosure and compliance.

On Capitol Hill, there’s movement, but no full agreement. The GENIUS Act is a positive step in demonstrating that bipartisan progress is possible. It lays out clear standards for payment stablecoins, including one-to-one reserve backing, transparent disclosures and monthly CPA attestations. It’s a meaningful step toward stability and trust, especially as broader market structure legislation continues to evolve and the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) signal a more coordinated, collaborative approach following their recent harmonization efforts. Without a unified federal approach, there’s a real risk of a state-by-state patchwork that slows innovation and complicates compliance.

Meanwhile, states and global regulators are stepping in to fill the gaps. State authorities are becoming more active in enforcement and consumer protection, while international coordination is ramping up. The U.S. and U.K. have launched a joint task force on digital assets, and efforts are underway to align with the EU’s Markets in Crypto-Assets Regulation (MiCA) framework, reflecting a shared understanding that digital assets are global by nature — and fragmented rules help no one.

Despite uncertainty, momentum is moving in the right direction. The U.S. is beginning to match the pace of global peers, signaling the next phase of regulatory clarity that will demand agility, awareness and continued leadership from the profession.

Firms are building for the next wave of client demand

As digital assets reshape client expectations, firms are rethinking how they build and deliver services. Many are developing dedicated digital asset practices, investing in staff training and leveraging technology to integrate blockchain capabilities into assurance and advisory functions. Firms that take a proactive approach are positioning themselves to meet growing demand from clients exploring digital assets, payments and treasury innovation.

Crypto-native companies seeking public listings or institutional investment often lack the financial infrastructure expected by regulators and investors. This is creating new service opportunities for CPAs to strengthen governance, design reporting processes and provide assurance over digital asset operations. For firms already investing in digital asset expertise, the focus is expanding beyond compliance to strategic advisory — helping clients understand risk, apply controls and capture efficiencies as blockchain becomes part of the financial mainstream.

The profession’s role has never been more critical

As digital assets become embedded in global finance, CPAs remain at the center of trust and accountability, helping clients navigate change, ensure compliance and bring assurance to a rapidly evolving market. In an era when technology drives transparency, trust still depends on people, and CPAs are defining what leadership looks like in the digital age.

Explore additional blockchain and digital asset resources

The following resources provide additional insights and tools:

- State of Blockchain infographic

- AICPA and CPA.com Tech Symposiums' overview

- Auditing blockchain and digital asset resources

- Stablecoin reporting and assurance resources

- The GENIUS Act summary of requirements

- Watch the Full AICPA Town Hall episode for federal shutdown updates, IRS changes and the state of digital assets in accounting