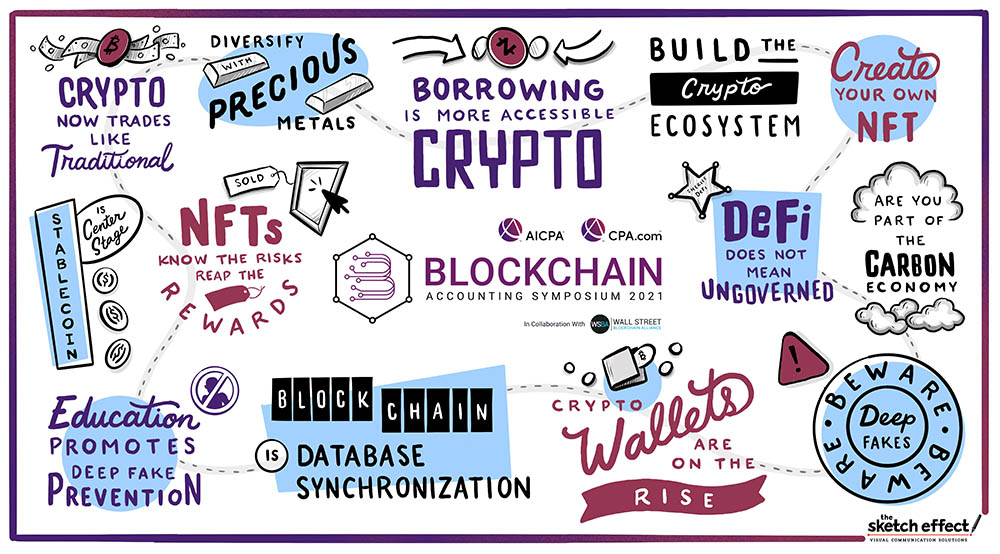

What a difference a year makes. The AICPA and CPA.com recently held their annual Blockchain in Accountancy Symposium in collaboration with the Wall Street Blockchain Alliance (WSBA), and the changes in the blockchain/crypto landscape couldn’t be starker. The event, now in its fourth year, brings together thought leaders, firms and advocates in accounting and finance to share updates, offer insights and work through issues in this area. CPA.com will be releasing a special report later this year that recaps the event, but if you’re eager for a preview, watch our LinkedIn Live with WSBA chairman Ron Quaranta or read on for five key takeaways:

- Crypto is expanding fast.

In almost every category, the cryptoasset space has advanced. At the time of the symposium, market cap stood at $1.39 trillion, up from $250 billion a year ago (Source: Coin Codex). The number of individual cryptoassets has risen 50% from last September, from roughly 7,000 to 10,540. Major financial services firms such as Visa, MasterCard, PayPal and Goldman Sachs are now allowing crypto on their networks. And the Office of the Comptroller of the Currency earlier this year authorized the first national crypto bank, Anchorage. - Regulators are hard-pressed to keep up with innovation.

The mechanics of blockchain and cryptoassets create many technical challenges for enforcement agencies. Panelists said policymakers have become more sophisticated in the past year and are asking the right questions about potential guidance, although that fluency can vary agency by agency. The IRS, for one, is devoting more resources to enforcement, but many challenges loom. - DeFi is the next frontier.

DeFi is decentralized finance, which replicates traditional finance services but runs over blockchains, deploys so-called “smart contracts,” and operates without third-party gatekeepers. “Two years ago, no one was talking about DeFi,” Quaranta said. Last year, the total value of this category was $1.66 billion. As of June 30, it stood at $51.5 billion. - Blockchain transactions are not untraceable.

Blockchain Intelligence Group, one of the companies that presented during the symposium, has developed tools that can identify high-risk transmissions over public blockchains linked to terrorism, ransomware or other financial crimes. Its clients include law enforcement agencies worldwide and corporate stakeholders. Other companies are developing similar forensic capabilities for blockchain transactions. “Anonymous does not mean invisible,” Quaranta said. - Keeping up is critical.

Whether you’re well-informed in crypto/blockchain or just getting familiar with this space, continuous education is paramount for the profession as things move quickly. Blockchain-specific news sites including CoinDesk and The Block are great information sources to inform CPAs and CGMAs. CPA.com and the AICPA & CIMA are also regularly developing new resources for the profession in this space, including a practice aid on digital assets, a whitepaper on blockchain risk for professionals and various learning programs. The WSBA and CPA.com also recently put together a primer on DeFi.

Stay tuned for the Special Report on the 2021 event and check out previous recaps of past Symposiums.