During a recent presentation for the firm-credit union-banker-regulator audience, an important topic that cuts across all the organizations today − staffing, or more specifically, challenges with finding and retaining quality staff – was discussed in detail.

New research by the American Institute of CPAsshows staff recruitment remains the top issue for most CPA firms, while risk management and compliance regarding privacy and data security are rising challenges.

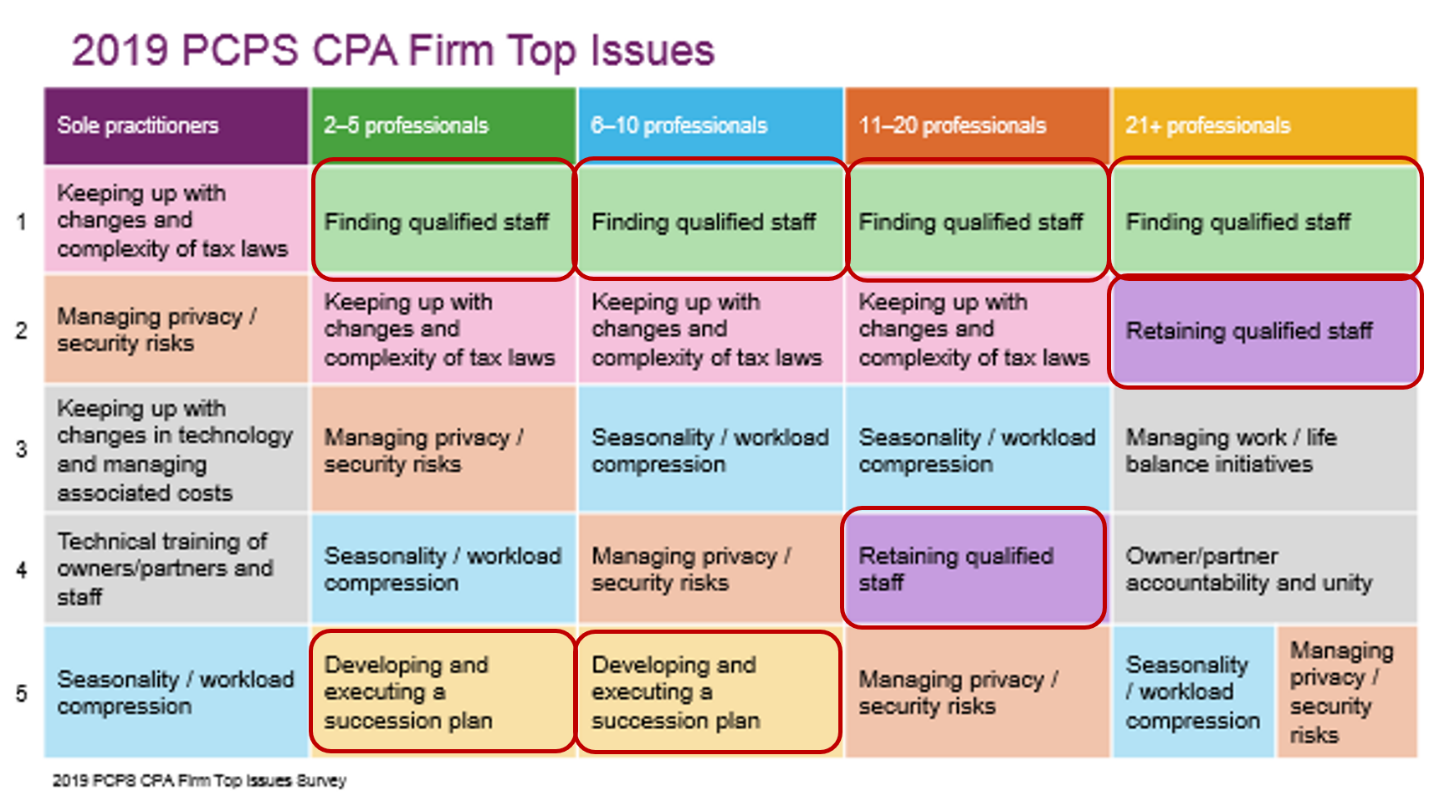

“Finding qualified staff” was the No. 1 issue for every firm-sized segment except sole practitioners, according to the 2019 PCPS CPA Firm Top Issues Survey; that matches the topline results from 2017, the last time the survey was conducted.

When we start to consider areas for improvement for firms today, finding and retaining qualified staff is rightly top of mind. Staffing issues for credit unions, banks and other private businesses and organizations are ever-present as well.

There’s a generational element for all employers that you’ll need to embrace (or be caught unprepared):

- Generation Z, born after 1996, is already here. 61M in the US and the first wave have graduated college already.

- Millennials will comprise the majority of the workforce in 2025. That’s just 5 years from now.

- Generation X workers begin retirement in 2030, and thanks to credit unions, in many cases they will retire or semi-retire because they’ve planned well, saved, and CAN retire.

Here’s a shocking finding from a new survey whose findings were just published in Harvard Business Review:

“About half of millennials, and 75% of Gen Zers, have left a job because of mental-health reasons.”

Credit unions (and smaller CPA firms) face another staffing risk: senior management and the C-suite. According to an article in Credit Union Times from 2012, the majority of the CEOs at credit unions with more than $100 million in assets are likely to retire in the next 10 years, so while this isn’t a new issue, it has been and is still a big issue.

While most credit unions have a succession plan prepared for their CEOs, less have one for other senior executives, and these are positions that can be much harder to fill. If you elevate an executive to CEO, who will replace them as CFO, Chief Lending officer, etc.? The AICPA PCPS study also listed succession planning as a top 5 issue for smaller firms, so this cuts across industries as well. These are real issues with big consequences if not addressed.

Attracting, developing and retaining talent is an immediate, short-term and longer-term priority for this entire eco-system, including firms and credit unions. How big of an issue is retaining staff? Over 40 million people now quit their job each year in the U.S. according to the Bureau of Labor Statistics. That is a 25% increase over just 5 years ago. A not-so-unrelated pair of statistics to note are:

- Just 32% of U.S. workers are “engaged” in their jobs

- Engaged employees are 59% less likely to seek out a new job in the next 12 months

Employee engagement is the real insight here.

A major initiative at leading organizations is now to create a positive work environment for new staff. From our discussions with firms and other organizations, we’re hearing that this often includes quickly getting new staff involved in what they consider to be meaningful, or at least interesting work. Preferably, that involves some type of interaction with clients (or “members” for the credit union folks). Having them working with innovative technology that facilitates member or customer interaction can be an ideal way to get new staff engaged quickly.

Many newer staff are digital natives, so they can get up to speed very fast and can bring insights as to incorporating new technology more effectively. Take advantage of that! Also consider asking a sampling of them what types of work would they find more engaging and valuable.

NOTE: If you’d like to hear more about CPA firm staffing issues and innovative ways to address them quickly, check out this key webinar, Addressing Staffing and Cultural Challenges in Attest Services, presented by CPA.com’s Matt Towers.

References/Links:

- https://www.aicpa.org/content/dam/aicpa/interestareas/privatecompaniespracticesection/...

- https://www.cnbc.com/2018/05/01/61-million-gen-zers-about-to-enter-us-workforce-and-change-it.html

- https://www.bls.gov/news.release/jolts.t04.html

- https://hbr.org/2019/10/research-people-want-their-employers-to-talk-about-mental-health

- https://www.cutimes.com/2012/01/31/ceo-talent-pool-is-shrinking-due-to-specialization/

- https://www.gallup.com/workplace/236483/enhances-benefits-employee-engagement.aspx

About the Author:

Steven A. Menges Assurance Team / RIVIO Clearinghouse Product Lead, CPA.com

A business-to-business (B2B) innovator and products executive with 20 years’ progressive experience, Steven Menges is a frequent industry author and speaker on enterprise computing, data analytics, managed service providers (MSPs), IT Security, regulatory compliance, EdTech, and buyer’s journey-based engagement.